Endowment & Planned Giving

“A society grows great when we plant trees whose shade we know we shall never sit in.”

Leave a Legacy For The Next 100 Years

For over 100 years, United Way of Buffalo & Erie County has worked to enhance the health, financial stability, and education of every person in our community. Your gift to the Endowment Fund will ensure that United Way can maximize the dollars available to support our mission for generations to come.

Contact Kristy Davis, Donor Relations Manager, for more information at (716) 887-2631 or kristy.davis@uwbec.org.

Any Gift of Any Size is Important

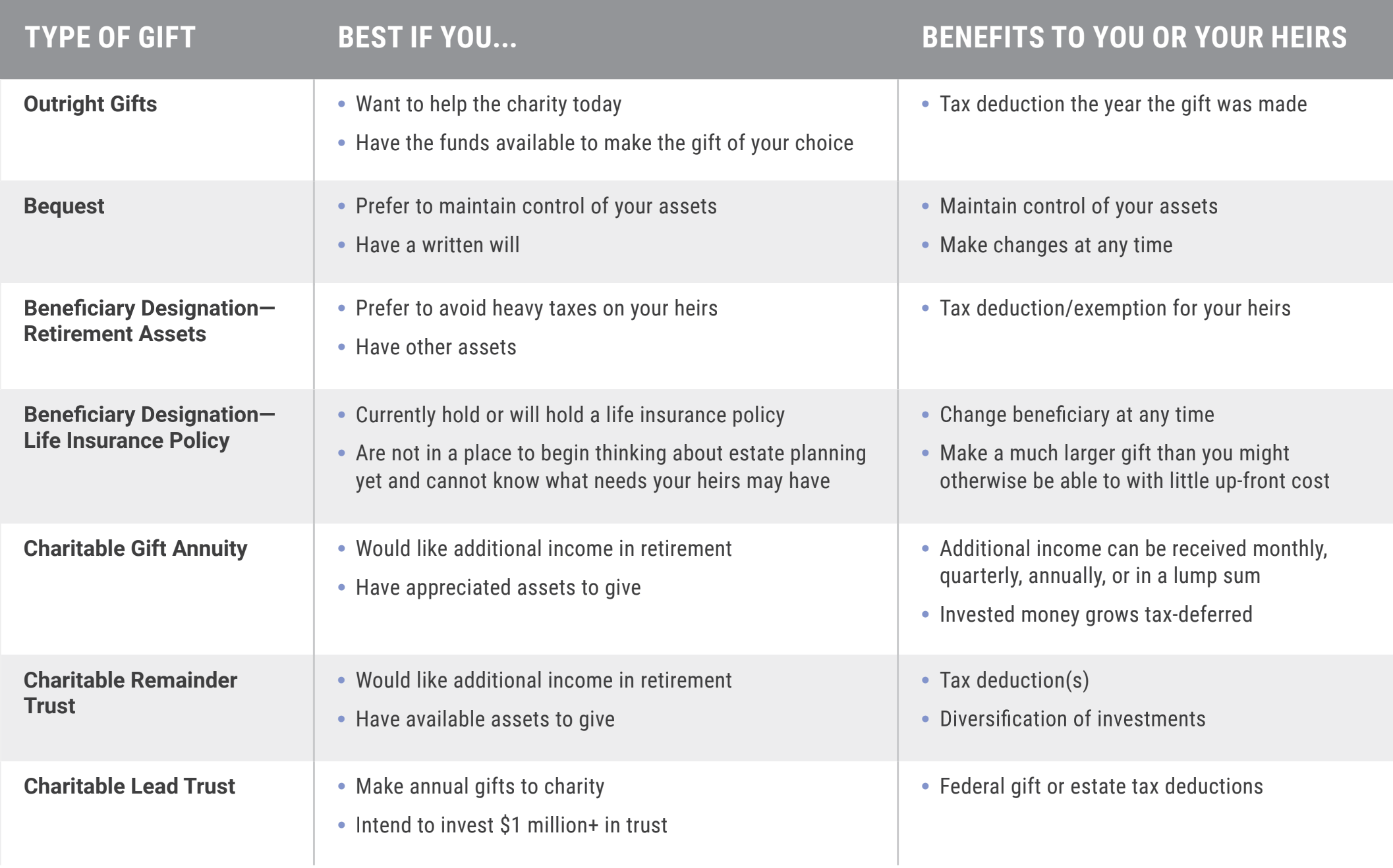

There are many ways to support United Way of Buffalo & Erie County’s Endowment Fund. Whether you wish to make monetary gifts or provide for United Way in your will, there are many options available to you. While estate planning is a thoughtful and personal process, certain gifting vehicles can help to make the process easier.

Each planned giving option has its own advantages. Even a modest gift can go a long way, given time, and a multi-year pledge can result in a larger gift than is possible in a single payment. Please see a financial advisor or lawyer to discuss the options that are best for you.

United Way Life, Freewill & Cryptocurrency

United Way Life

Do you want to easily and affordably magnify your impact on the community at a young age? By using life insurance, the United Way Life program offers the easiest and most cost-effective way to leave your legacy to benefit Buffalo & Erie County.

Benefits

- Leave a six-figure gift that fulfills your charitable legacy at a surprisingly young age

- Make affordable payments when United Way matches part of your life insurance policy

- Qualify for an income tax deduction

- Receive public recognition as a major donor now and past your lifetime

- Gain membership to United Way’s reputable Tocqueville Society and Leadership Society

Freewill

We have partnered with FreeWill to give all of our supporters the opportunity to write their legally valid wills online for free. In less than 20 minutes, you will have a will that is valid in all 50 states.

If you have a more complicated estate, FreeWill can be used to create a set of documented wishes to bring to a lawyer’s office and save time and money.

Secure your legacy and write your will today.

Cryptocurrency

Donating cryptocurrency is more tax efficient than donating cash, saving you money. You do not owe capital gains tax on the appreciated amount and can deduct it on your taxes. That means you’re able to donate more to charity, as well as deduct more on your tax return.

To easily and securely give, visit cryptoforcharity.io/uwbec.

Donations of appreciated crypto can be up to 20% more valuable than selling and donating the cash, allowing you to make a bigger impact and save on taxes.

Contact Kristy Davis, Donor Relations Manager, for more information at (716) 887-2631 or kristy.davis@uwbec.org.

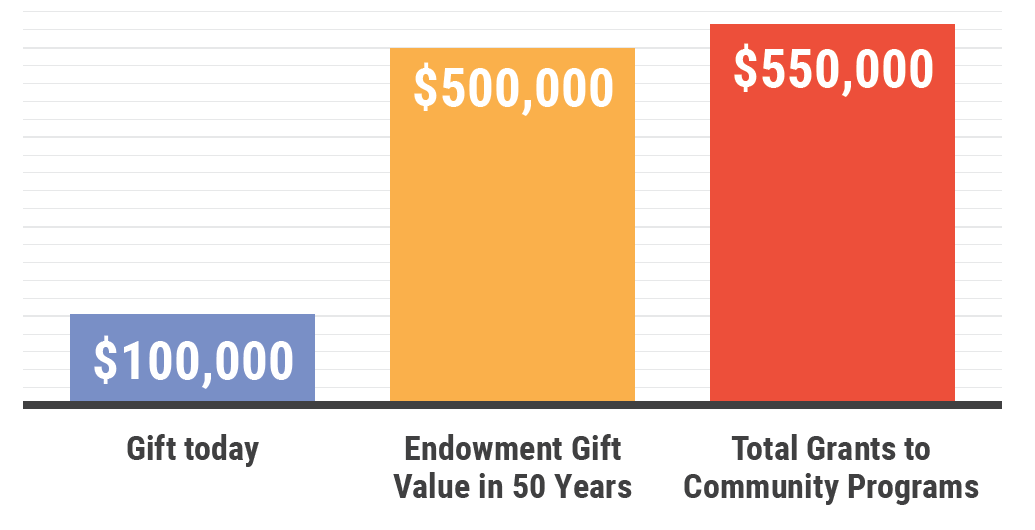

The Power Of Your Gift

The power of your gift cart is shown here. Gift today is 100,000. Endowment Gift Value in 50 years is 500,000. Total Grants to Community Programs is 550,000.

A $100,000 endowment gift today is expected to grow to over $500,000 in 50 years and during that time will give over $550,000 in funds to support education, financial stability, and health programs in our community.